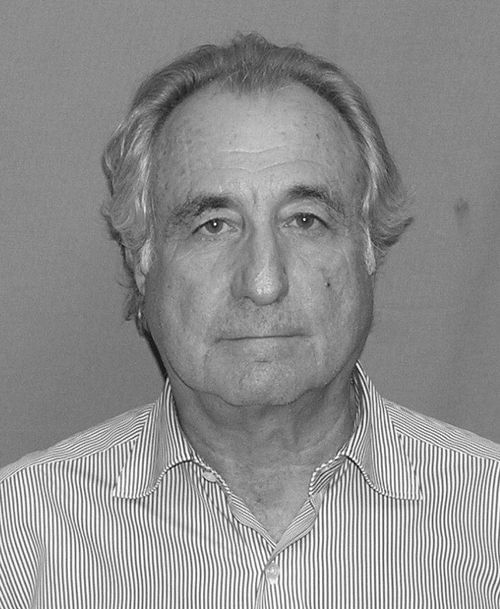

Photo Attribution: U.S. Department of Justice, Public domain, via Wikimedia Commons

Bernie Madoff

This example has been viewed 916x times

Summary

Rodden Rating

Analysis for Bernie Madoff

Biography

Bernard Lawrence Madoff (/ˈmeɪdɔːf/ MAY-dawf;[1] April 29, 1938 – April 14, 2021) was an American fraudster and financier who was the mastermind of the largest Ponzi scheme in history, worth about $64.8 billion.[2][3] He was at one time chairman of the NASDAQ stock exchange.[4] Madoff's firm had two basic units: a stock brokerage and an asset management business; the Ponzi scheme was centered in the asset management business.

Madoff founded a penny stock brokerage in 1960, which eventually grew into Bernard L. Madoff Investment Securities.[5] He served as the company's chairman until his arrest on December 11, 2008.[6][7] That year, the firm was the 6th-largest market maker in S&P 500 stocks.[8] While the stock brokerage part of the business had a public profile, Madoff tried to keep his asset management business low profile and exclusive.

At the firm, he employed his brother Peter Madoff as senior managing director and chief compliance officer, Peter's daughter Shana Madoff as the firm's rules and compliance officer and attorney, and his now-deceased sons Mark Madoff and Andrew Madoff. Peter was sentenced to 10 years in prison in 2012,[9] and Mark hanged himself in 2010, exactly two years after his father's arrest.[10][11][12][13] Andrew died of lymphoma on September 3, 2014.[14]

On December 10, 2008, Madoff's sons Mark and Andrew told authorities that their father had confessed to them that the asset management unit of his firm was a massive Ponzi scheme, and quoted him as saying that it was "one big lie".[15][16][17] The following day, agents from the Federal Bureau of Investigation arrested Madoff and charged him with one count of securities fraud. The U.S. Securities and Exchange Commission (SEC) had previously conducted multiple investigations into his business practices but had not uncovered the massive fraud.[8] On March 12, 2009, Madoff pleaded guilty to 11 federal felonies and admitted to turning his wealth management business into a massive Ponzi scheme.

The Madoff investment scandal defrauded thousands of investors of billions of dollars. Madoff said that he began the Ponzi scheme in the early 1990s, but an ex-trader admitted in court to faking records for Madoff since the early 1970s.[18][19][20] Those charged with recovering the missing money believe that the investment operation may never have been legitimate.[21][22] The amount missing from client accounts was almost $65 billion, including fabricated gains.[23] The Securities Investor Protection Corporation (SIPC) trustee estimated actual losses to investors of $18 billion,[21] of which $14.418 billion has been recovered and returned, while the search for additional funds continues.[24] On June 29, 2009, Madoff was sentenced to 150 years in prison, the maximum sentence allowed.[25][26][27][28] On April 14, 2021, he died at the Federal Medical Center, Butner, in North Carolina, from chronic kidney disease.[29][30][31][32]

Source: https://en.wikipedia.org/wiki/Bernie_Madoff

Raw Data

Horoscope Data

Comments

Natal Data

1938-04-29 13:50:00 LMT

40° 42′ 46.0″ N 74° 0′ 21.5″ W

New York, NY, USA

.jpg?bossToken=2742eeb6d6d7a8ebcb174a253f5dd42a5e0652c68a0deb15e0f8f302ee31549d)